| Samstaša žjóšar

NATIONAL UNITY COALITION

Barįttusamtök fyrir sjįlfstęšu rķki į Ķslandi og fullveldisréttindum almennings.

Stöndum vörš um Stjórnarskrį Lżšveldisins. |

The Hong Kong Dollar, Rock Solid.Fyrst birt ķ Globe Asia marz 2016.

Steve H. Hanke.

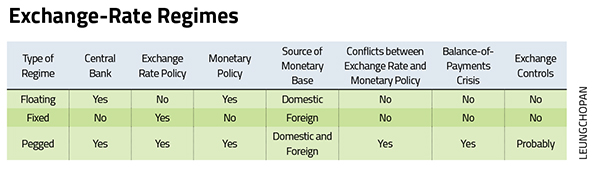

The currency speculators are restless, again. Many, like George Soros and Kyle Bass, are reportedly taking aim at the Hong Kong dollar (HKD). HKD bear circles think China’s renmimbi (RMB) will lose value against the U.S. dollar (USD) as China’s economy slows down and capital flight from China continues. This, it is asserted, will put pressure on the HKD, and force its devaluation. Thus rendering the fixed rate of 7.8 HKD/USD null and void, and pumping profits into the pockets of those who bet on a devaluation of the HKD. Like past speculative attacks against the HKD, this will fail and the bears will be forced back into hibernation, suffering large losses. What is fascinating is how so many experienced currency speculators, like George Soros, can be so ill-informed about Hong Kong’s monetary setup. This is far from the first speculative attack on the HKD; the most massive occurred during the Asian Financial Crisis of 1997-98. We cannot forget hedge fund guru Bill Ackerman’s well-advertised “bet the house” attack against the HKD in 2011. It failed badly. The currency speculators aren’t the only ones ill-informed about Hong-Kong. Financial journalists — even veterans with Hong Kong market experience — clearly don’t understand the currency board system that governs the course of the HKD. For example, Jake van der Kamp, a columnist at the South China Morning Post and former analyst at Morgan Stanley, recently fanned the speculative flames by penning a provocative column titled “From a Currency Board to a Banana Republic Manipulation.” This brought out a response from John Greenwood, the architect of Hong Kong’s currency board system, installed in 1983, and a member of the Currency Board Committee of the Hong Kong Monetary Authority. Greenwood politely took van der Kamp to the woodshed and told him that he didn’t know what he was talking about, and van der Kamp had the good sense to admit that he had sinned. So, why is there so much confusion about exchange rates — particularly fixed exchange rates delivered by currency board systems, like Hong Kong’s? To answer that question, we must develop a taxonomy of exchange-rate regimes and their characteristics. As shown in the accompanying table, there are three types of regimes: floating, fixed, and pegged.

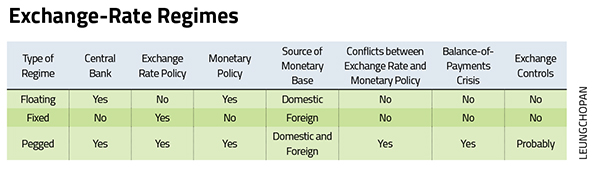

Athugasemd: Sem vörn gegn gengisfellingum eru flot-gengi (floating exchange rate) og gengis-tylling (pegged exchange rate) jafn gagnslaus. Gengis-tylling mun alltaf gefa eftir, fyrir žrżstingi į gjaldmišilinn. Eini munurinn er aš ferill gengisfallsins er ósamfelldur. Fast-gengi er eina gengisstefnan sem megnar aš halda genginu föstu til langframa. Fast-gengi getur annars vegar veriš undir stjórn myntrįšs og žį er notast viš innlendan gjaldmišil og śtlenda stošmynt, eša um er aš ręša Dollaravęšingu. Dollaravęšing merkir, aš ķ staš innlends gjaldmišils er einhver śtlendur gjaldmill notašur. In fixed and floating rate regimes the monetary authority aims for only one target at a time. Although floating and fixed rates appear dissimilar, they are members of the same free-market family. Both operate without exchange controls and are free-market mechanisms for balance-of-payments adjustments. With a floating rate, a central bank sets a monetary policy, but the exchange rate is on autopilot. In consequence, the monetary base is determined domestically by a central bank. With a fixed rate, there are two possibilities: either a currency board sets the exchange rate and the money supply is on autopilot, or a country is “dollarized” and uses the U.S. dollar, or another foreign currency, as its own and the money supply is again on autopilot. Under a fixed-rate regime, a country’s monetary base is determined by the balance of payments, which move in a one-to-one correspondence with changes in its foreign reserves. With either a floating or a fixed rate, there cannot be conflicts between monetary and exchange rate policies, and balance-of-payments crises cannot rear their ugly heads. Floating and fixed-rate regimes are inherently equilibrium systems in which market forces act to automatically rebalance financial flows and avert balance-of- payments crises. Most people use “fixed” and “pegged” as interchangeable or nearly interchangeable terms for exchange rates. In reality, they are very different exchange-rate arrangements. Pegged-rate systems are those in which the monetary authority aims for more than one target at a time. They come in many varieties: crawling pegs, adjustable pegs, bands, managed floats, and more. Pegged systems often employ exchange controls and are not free-market mechanisms for international balance-of-payments adjustments. They are inherently disequilibrium systems, lacking an automatic adjustment mechanism. They require a central bank to manage both the exchange rate and monetary policy. With a pegged rate, the monetary base contains both domestic and foreign components. Unlike floating and fixed rates, pegged rates invariably result in conflicts between monetary and exchange rate policies. For example, when capital inflows become “excessive” under a pegged system, a central bank often attempts to sterilize the ensuing increase in the foreign component of the monetary base by selling bonds, reducing the domestic component of the base. And when outflows become “excessive,” a central bank often attempts to offset the decrease in the foreign component of the monetary base by buying bonds, increasing the domestic component of the monetary base. Balance-of-payments crises erupt as a central bank begins to offset more and more of the reduction in the foreign component of the monetary base with domestically created base money. When this occurs, it is only a matter of time before currency speculators spot the contradictions between exchange rate and monetary policies and force a devaluation, interest-rate increases, the imposition of exchange controls, or all three. As the accompanying monetary composition chart makes clear, China’s RMB falls into the pegged regime category. The RMB’s monetary base has foreign and domestic components that move around. In addition, China imposes capital controls. So, the RMB bears might be smelling blood.

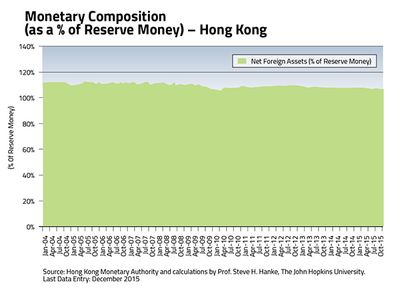

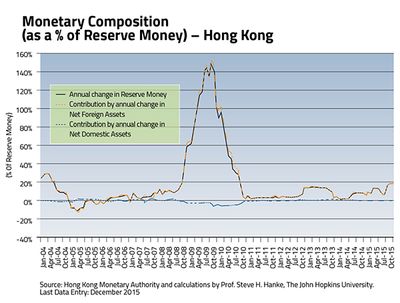

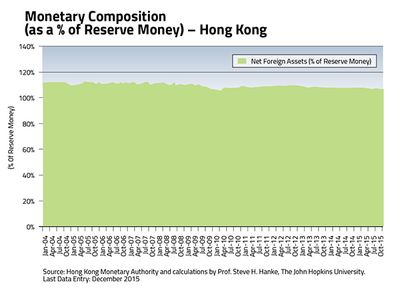

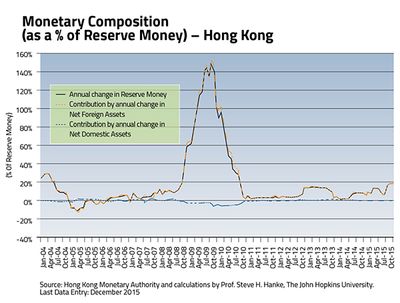

That’s not the case with the HKD, which is linked to the USD via a currency board. As such, the board’s monetary base (reserve money) must be backed by foreign reserves — 100%, or slightly more. The accompanying chart shows that this so-called currency board “backing (or ‘stock’) rule” is strictly followed in Hong Kong. The “flow rule” — that reserve money must change in a one-to-one relationship with changes in the currency board’s foreign exchange reserves — is also strictly followed in Hong Kong (see the accompanying chart).

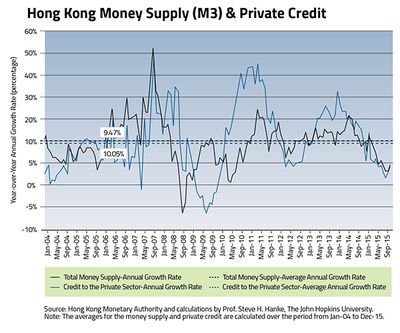

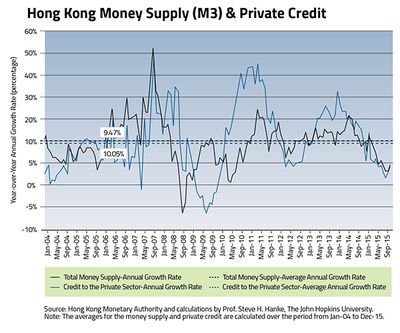

There has never been a system that followed currency board rules — like Hong Kong’s — that has been broken by a speculative attack. And Hong Kong’s will not be the first. Indeed, its currency board is operating exactly as it should, which is why it can’t be broken. So, what will happen? When the U.S. Fed embraced quantitative easing, USDs flowed into Hong Kong. Now that the Fed has started to notch up the Fed funds rate, the flows have reversed. In consequence, the currency board is automatically tightening up, and both broad money and credit to the private sector are decelerating and are below their trend rates (see the accompanying chart).

This is just what is supposed to happen. We should expect a slow-down in the Hong Kong economy. But, the HKD will remain rock solid. |

Anna Björg Hjartardóttir

Anna Björg Hjartardóttir

Anna Ólafsdóttir Björnsson

Anna Ólafsdóttir Björnsson

Axel Jóhann Axelsson

Axel Jóhann Axelsson

Axel Þór Kolbeinsson

Axel Þór Kolbeinsson

Benedikta E

Benedikta E

Bjarni Harðarson

Bjarni Harðarson

Eggert Guðmundsson

Eggert Guðmundsson

Einar Björn Bjarnason

Einar Björn Bjarnason

Einar Gunnar Birgisson

Einar Gunnar Birgisson

Elle_

Elle_

Emil Örn Kristjánsson

Emil Örn Kristjánsson

Eyþór Laxdal Arnalds

Eyþór Laxdal Arnalds

Friðrik Hansen Guðmundsson

Friðrik Hansen Guðmundsson

Frosti Sigurjónsson

Frosti Sigurjónsson

Geir Ágústsson

Geir Ágústsson

Gunnar Heiðarsson

Gunnar Heiðarsson

Gunnar Rögnvaldsson

Gunnar Rögnvaldsson

Gunnar Skúli Ármannsson

Gunnar Skúli Ármannsson

Gunnlaugur I.

Gunnlaugur I.

Guðmundur Jónas Kristjánsson

Guðmundur Jónas Kristjánsson

Guðmundur Kjartansson

Guðmundur Kjartansson

Guðmundur Ásgeirsson

Guðmundur Ásgeirsson

Guðni Karl Harðarson

Guðni Karl Harðarson

Guðrún María Óskarsdóttir.

Guðrún María Óskarsdóttir.

Guðrún Sæmundsdóttir

Guðrún Sæmundsdóttir

Gústaf Adolf Skúlason

Gústaf Adolf Skúlason

Haraldur Baldursson

Haraldur Baldursson

Haraldur Hansson

Haraldur Hansson

Haraldur Haraldsson

Haraldur Haraldsson

Helga Kristjánsdóttir

Helga Kristjánsdóttir

Helga Þórðardóttir

Helga Þórðardóttir

Hjörleifur Guttormsson

Hjörleifur Guttormsson

Ingibjörg Guðrún Magnúsdóttir

Ingibjörg Guðrún Magnúsdóttir

Jakobína Ingunn Ólafsdóttir

Jakobína Ingunn Ólafsdóttir

Jóhann Páll Símonarson

Jóhann Páll Símonarson

Jón Baldur Lorange

Jón Baldur Lorange

Jón Lárusson

Jón Lárusson

Jón Magnússon

Jón Magnússon

Jón Ríkharðsson

Jón Ríkharðsson

Jón Valur Jensson

Jón Valur Jensson

Kjartan Eggertsson

Kjartan Eggertsson

Kolbrún Hilmars

Kolbrún Hilmars

Kristbjörg Þórisdóttir

Kristbjörg Þórisdóttir

Kristin stjórnmálasamtök

Kristin stjórnmálasamtök

Kristinn Snævar Jónsson

Kristinn Snævar Jónsson

Kristján P. Gudmundsson

Kristján P. Gudmundsson

Ragnar Þór Ingólfsson

Ragnar Þór Ingólfsson

Ragnhildur Kolka

Ragnhildur Kolka

S i g u r ð u r S i g u r ð a r s o n

S i g u r ð u r S i g u r ð a r s o n

Samtök um rannsóknir á ESB ...

Samtök um rannsóknir á ESB ...

Sigurbjörg Eiríksdóttir

Sigurbjörg Eiríksdóttir

Sigurjón Þórðarson

Sigurjón Þórðarson

Sigurður Sigurðsson

Sigurður Sigurðsson

Sigurður Þórðarson

Sigurður Þórðarson

Tryggvi Helgason

Tryggvi Helgason

Valan

Valan

Valdimar Samúelsson

Valdimar Samúelsson

Viggó Jörgensson

Viggó Jörgensson

Vilhjálmur Örn Vilhjálmsson

Vilhjálmur Örn Vilhjálmsson

au

au

Ásthildur Cesil Þórðardóttir

Ásthildur Cesil Þórðardóttir

Ægir Óskar Hallgrímsson

Ægir Óskar Hallgrímsson

Ívar Pálsson

Ívar Pálsson

Ólafur Örn Jónsson

Ólafur Örn Jónsson

Óskar Helgi Helgason

Óskar Helgi Helgason

Óðinn Þórisson

Óðinn Þórisson

Örn Ægir Reynisson

Örn Ægir Reynisson

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

Þráinn Jökull Elísson

Þráinn Jökull Elísson

Þórólfur Ingvarsson

Þórólfur Ingvarsson

Högni Snær Hauksson

Högni Snær Hauksson

Íslenska þjóðfylkingin

Íslenska þjóðfylkingin

Jóhann Kristinsson

Jóhann Kristinsson

Jón Valur Jensson

Jón Valur Jensson

Lífsréttur

Lífsréttur