10.5.2013 | 15:01

Steve H. Hanke: Dollarize Argentina Now

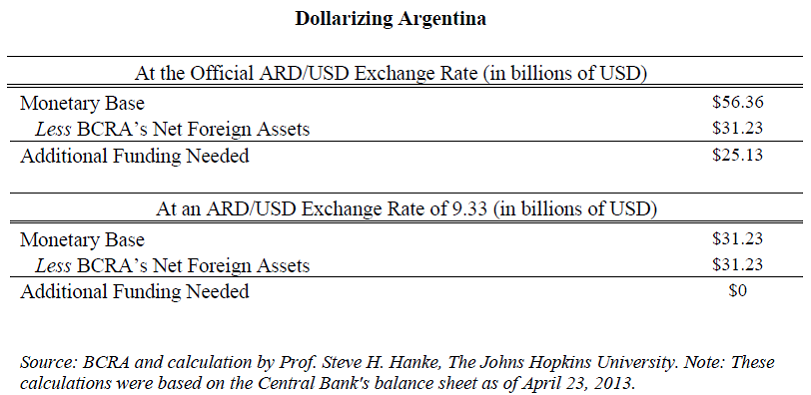

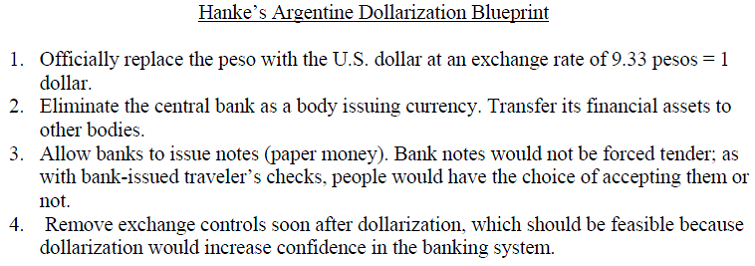

Steve H. Hanke: Dollarize Argentine Now.Fyrst birt hjį CATO Institute 08. maķ 2013.Steve H. Hanke.Argentina is once again wrestling with its long-time enemy – inflation. Now, it appears history may soon repeat itself, as Argentina teeters on the verge of another currency crisis. As of Tuesday morning, the black-market ARD/USD exchange rate hit 9.87, meaning the peso’s value now sits 47.3% below the official exchange rate.This yields an implied annual inflation rate of 98.3%. For now, the effects of this elevated inflation rate are being subdued somewhat by Argentina’s massive price control regime. But, these price controls are not sustainable in the long term. Indeed, the short-term “lying prices” they create only distort the economic reality, ultimately leading to scarcity.There is, however, a simple solution to Argentina’s monetary problems – dollarization. I have advocated dollarization in Argentina for over two decades – well before the blow up of their so-called “currency board”. To put the record straight, Argentina did not have a true currency board from 1991-2002. Rather, as I anticipated in 1991, the “convertibility system” acted more like a central bank than a currency board. This pegged exchange rate system was bound to fail… and fail, it did.The 2001-02 Argentine Crisis could have easily been avoided if the country had simply dollarized. Argentina had more than sufficient foreign assets to dollarize their economy even late into 2001. But, the Argentine government – through a series of policy blunders – ended up “floating” the currency. Not surprisingly, Argentina is now back to where it was in the late 1980s.So, how can Argentina dollarize? In short, the Banco Central de la Republica Argentina (BRCA) would take all of the assets and liabilities on its balance sheet denominated in foreign currency and convert them to U.S. dollars. The Central Bank would then exchange these dollars for all the pesos in circulation (monetary base), at a fixed exchange rate. By my calculation, the BRCA would need at least $56.36 billion to dollarize at the official exchange rate (as of 23 April 2013).As of April 23, the BRCA had net foreign assets equivalent to $31.23 billion. If Argentina were to dollarize at the official ARD/USD exchange rate of 5.17, it would still fall $25.13 billion short of the $56.36 billion needed to cover the monetary base. That said, if the BRCA were to use an exchange rate closer to the black-market (read:free-market) exchange rate, this could be more easily accomplished.For example, if Argentina decided to dollarize at an ARD/USD exchange rate of 9.33 pesos to the dollar (5.5% lower than the black-market ARD/USD exchange rate as of Tuesday) only $31.23 billion would be required to cover its monetary base and dollarize the economy. This is the exact amount of net foreign assets held by the BCRA (see the accompanying table). |

Meginflokkur: Evrópumįl | Aukaflokkar: Stjórnmįl og samfélag, Utanrķkismįl/alžjóšamįl, Višskipti og fjįrmįl | Breytt s.d. kl. 15:02 | Facebook

Anna Björg Hjartardóttir

Anna Björg Hjartardóttir

Anna Ólafsdóttir Björnsson

Anna Ólafsdóttir Björnsson

Axel Jóhann Axelsson

Axel Jóhann Axelsson

Axel Þór Kolbeinsson

Axel Þór Kolbeinsson

Benedikta E

Benedikta E

Bjarni Harðarson

Bjarni Harðarson

Eggert Guðmundsson

Eggert Guðmundsson

Einar Björn Bjarnason

Einar Björn Bjarnason

Einar Gunnar Birgisson

Einar Gunnar Birgisson

Elle_

Elle_

Emil Örn Kristjánsson

Emil Örn Kristjánsson

Eyþór Laxdal Arnalds

Eyþór Laxdal Arnalds

Friðrik Hansen Guðmundsson

Friðrik Hansen Guðmundsson

Frosti Sigurjónsson

Frosti Sigurjónsson

Geir Ágústsson

Geir Ágústsson

Gunnar Heiðarsson

Gunnar Heiðarsson

Gunnar Rögnvaldsson

Gunnar Rögnvaldsson

Gunnar Skúli Ármannsson

Gunnar Skúli Ármannsson

Gunnlaugur I.

Gunnlaugur I.

Guðmundur Jónas Kristjánsson

Guðmundur Jónas Kristjánsson

Guðmundur Kjartansson

Guðmundur Kjartansson

Guðmundur Ásgeirsson

Guðmundur Ásgeirsson

Guðni Karl Harðarson

Guðni Karl Harðarson

Guðrún María Óskarsdóttir.

Guðrún María Óskarsdóttir.

Guðrún Sæmundsdóttir

Guðrún Sæmundsdóttir

Gústaf Adolf Skúlason

Gústaf Adolf Skúlason

Haraldur Baldursson

Haraldur Baldursson

Haraldur Hansson

Haraldur Hansson

Haraldur Haraldsson

Haraldur Haraldsson

Helga Kristjánsdóttir

Helga Kristjánsdóttir

Helga Þórðardóttir

Helga Þórðardóttir

Hjörleifur Guttormsson

Hjörleifur Guttormsson

Ingibjörg Guðrún Magnúsdóttir

Ingibjörg Guðrún Magnúsdóttir

Jakobína Ingunn Ólafsdóttir

Jakobína Ingunn Ólafsdóttir

Jóhann Páll Símonarson

Jóhann Páll Símonarson

Jón Baldur Lorange

Jón Baldur Lorange

Jón Lárusson

Jón Lárusson

Jón Magnússon

Jón Magnússon

Jón Ríkharðsson

Jón Ríkharðsson

Jón Valur Jensson

Jón Valur Jensson

Kjartan Eggertsson

Kjartan Eggertsson

Kolbrún Hilmars

Kolbrún Hilmars

Kristbjörg Þórisdóttir

Kristbjörg Þórisdóttir

Kristin stjórnmálasamtök

Kristin stjórnmálasamtök

Kristinn Snævar Jónsson

Kristinn Snævar Jónsson

Kristján P. Gudmundsson

Kristján P. Gudmundsson

Ragnar Þór Ingólfsson

Ragnar Þór Ingólfsson

Ragnhildur Kolka

Ragnhildur Kolka

S i g u r ð u r S i g u r ð a r s o n

S i g u r ð u r S i g u r ð a r s o n

Samtök um rannsóknir á ESB ...

Samtök um rannsóknir á ESB ...

Sigurbjörg Eiríksdóttir

Sigurbjörg Eiríksdóttir

Sigurjón Þórðarson

Sigurjón Þórðarson

Sigurður Sigurðsson

Sigurður Sigurðsson

Sigurður Þórðarson

Sigurður Þórðarson

Tryggvi Helgason

Tryggvi Helgason

Valan

Valan

Valdimar Samúelsson

Valdimar Samúelsson

Viggó Jörgensson

Viggó Jörgensson

Vilhjálmur Örn Vilhjálmsson

Vilhjálmur Örn Vilhjálmsson

au

au

Ásthildur Cesil Þórðardóttir

Ásthildur Cesil Þórðardóttir

Ægir Óskar Hallgrímsson

Ægir Óskar Hallgrímsson

Ívar Pálsson

Ívar Pálsson

Ólafur Örn Jónsson

Ólafur Örn Jónsson

Óskar Helgi Helgason

Óskar Helgi Helgason

Óðinn Þórisson

Óðinn Þórisson

Örn Ægir Reynisson

Örn Ægir Reynisson

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

ÞJÓÐARHEIÐUR - SAMTÖK GEGN ICESAVE

Þráinn Jökull Elísson

Þráinn Jökull Elísson

Þórólfur Ingvarsson

Þórólfur Ingvarsson

Högni Snær Hauksson

Högni Snær Hauksson

Íslenska þjóðfylkingin

Íslenska þjóðfylkingin

Jóhann Kristinsson

Jóhann Kristinsson

Jón Valur Jensson

Jón Valur Jensson

Lífsréttur

Lífsréttur